does your efc for college stay the same no matter what school you apply to?

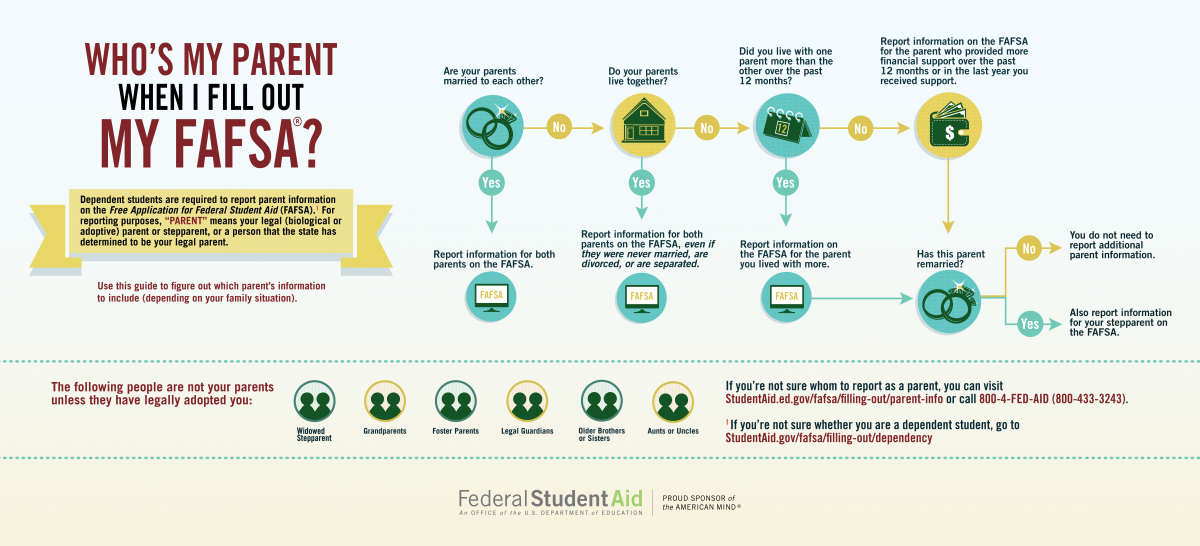

Though the FAFSA might be a little more than complicated when you take divorced or never-married parents, your family state of affairs shouldn't hold you back from receiving as much educatee aid as possible. Hither, nosotros'll walk you through some basic tips that to make completing your FAFSA a piffling easier no affair what your family situation is. The FAFSA uses information almost your family's financial situation to determine your financial aid eligibility. That ways y'all'll need income information from your parents — only the people y'all consider your parents may non be the same ones that count on the FAFSA. That'southward important, because the data y'all enter will exist used to adamant your expected family contribution or EFC. This is a formula that takes into account your family's revenue enhancement information, untaxed income, assets, and benefits. The EFC also considers the size of your family and the number of other kids in your family attending college during the year. So whose data should you enter? This infographic from the U.S Section of Education is super helpful in figuring how the FAFSA defines who'due south who in your family tree. If your parents aren't divorced, make full out the FAFSA with details from both of them. If they are divorced, things offset to become a niggling trickier, equally only one parent is considered a parent for FAFSA purposes in this situation. If your parents live together, even if they are separated, were never married, or are divorced, you file the FAFSA with income information from both of them. If your parents are divorced, separated, or were never married and don't live together, you fill out the FAFSA based on your custodial parent. That'southward the parent you physically live with more than the other. Note that having "legal custody" does not automatically equal custodial-parent status. Rather, it'southward a question of where you spend the most time and which parent provides the most financial back up. If you alive with both parents as, you fill up out the FAFSA based on the parent who gave you more financial support in the last year. Run into also: How Does the FAFSA Work? If your parents don't live together and your custodial parent (or your parent who supported you financially) has gotten remarried, you exercise demand to report your stepparent's information on the FAFSA. And in that case, you do not report income information from your noncustodial or not-financially supportive parent. If your custodial parent just lives with a new significant other and is non legally married, you lot only demand to report your legal guardian's income information. All the same, if the meaning other is helping with hire or utilities, those contributions must be listed every bit nontaxable income. Of form, the wrench in that situation is mutual-police union. If your parent and their significant other take been together for a sure amount of time and basically alive as if they're married, your state may recognize them as so. If common law spousal relationship applies to your family, you do count the custodial parent'due south significant other as a stepparent. If y'all live with someone other than your parents, you still study your parent's information on FAFSA, unless the person you live with has legally adopted y'all. Run into also: 11 Common FAFSA Mistakes that Tin Price Y'all Money No matter what your parents' marital condition is, you'll demand to share the same information as other students. According to the Federal Educatee Aid website this includes: Besides, some schools may crave a re-create of the divorce agreement in deciding on financial aid, only you lot will not need that information when yous submit the FAFSA. See also: Nosotros Answer Your FAFSA Questions Remember that you don't need to include the financial data of every adult in your life. If y'all do, you're over-reporting income and information technology could cause you lot to lose out on fiscal aid. Focus your application on the custodial parent and you'll be fine. Noncustodial parents may exist required to provide information later to some private schools when assistance is being awarded, but there's no demand to overreach with FAFSA. Also, be enlightened that alimony is considered taxable income and should already be included in the custodial parent's tax data. Don't report it separately, like you exercise with kid support, which is untaxed. Doing so means you're again over-reporting income and it may reduce what's offered in your financial package. In that location are a few ways to use divorced, separated, or unmarried parental marital status to your financial assist reward. Ane is by ensuring that your custodial parent is the ane who makes less coin. By living with the parent who earns less, yous EFC will exist lower and your aid package could exist college. Just, don't falsely report who y'all live with based on income — that's fraud. Divorce settlement agreements tin (and should) include the written details of a college support plan. In this case, parents make up one's mind the percentage of college costs each person is responsible for and what expenses volition be covered past each parent. With these agreements in place, the custodial parent all the same fills out the FAFSA, simply there'south a plan in identify for actually roofing the EFC so that it doesn't fall solely on one parent'due south shoulders. Run across likewise: The #1 Nigh-Costly Mistake People Make When Paying for College Hopefully, these tips assistance you fill out the FAFSA if your family situation isn't "traditional." Remember, financial assist advisors at colleges are experts in these FAFSA rules. When in incertitude, ask them for help. Exist certain to check our question-by-question FAFSA guide to help ensure that you qualify for the maximum corporeality of financial aid that you lot're entitled to.

1. Know who to define as a "parent"

What about stepparents and single significant others?

What virtually common-law spouses?

What if you live with someone other than a parent?

2. Get together the right info

iii. Don't overshare

4. Know how to work the situation for more help

Don't be afraid to enquire for assist

Nigh the Author

Carol Katarsky is a contributing author for Nitro. She is an award-winning journalist with extensive experience writing about both finance and education. Her corporate and non-turn a profit clients include AIG, Children'south Infirmary of Philadelphia, and the Projection Management Institute. She lives in Philadelphia with her husband, son, and one cat more than than she should. Read more than past Carol Katarsky

Source: https://www.nitrocollege.com/blog/4-fafsa-tips-students-divorced-parents

0 Response to "does your efc for college stay the same no matter what school you apply to?"

Post a Comment